-

25 mai 2021

Europe vs. America: the federal governance matters

Europe and America have been strikingly different in terms of the Corona-era big-relief packages, and the roll out of Covid-19 vaccination. These differences are rooted in differences in their federal governance. Governance differences in the federal system matters also for migrants skill composition, tax burden, and the generosity of the welfare state. lire la suite

-

29 mars 2019

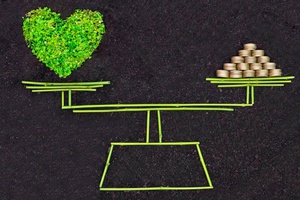

Let’s not oppose climate policies and purchasing power! Lessons from the French climate transition

Rising green taxes on gasoline initially sparked the “Yellow Jackets” movement in November 2018. The winter of discontent that came with the tax riots reminds us of the importance of reconciling protection of purchasing power with that of the climate. lire la suite

-

23 mai 2018

Fiscal money is an illusion, not a solution

In their recent Telos post, a group of Italian economists who name themselves the Group of Fiscal Money assert that Credit Tax Certificates, which are tax assets, would not increase the Italian government deficit and would even contribute to curtail the debt burden. I am not convinced by their argumentation. lire la suite

-

23 mai 2018

Fiscal money as a solution to Italian eurowoes

As fiscal rules constrain Italy’s ability to reflate demand by issuing debt, and with monetary policy being as accommodative as it gets, an alternative instrument is required. Fiscal Money provides such instrument. Our proposal is for government to issue transferable and negotiable bonds, which bearers may use for tax rebates two years after issuance. lire la suite

-

5 novembre 2010

EU: tax harmonization in sight?

Led by EU Commissioner Algirdas Šemeta, the new Tax Policy Group brings together personal representatives of EU Finance Ministers to discuss key tax policy issues. The Group aims to work on fundamental topics such as how taxation can contribute to a stronger Internal Market, to the growth and competitiveness of Europe's economy and to a "greener" economy. It will also serve as a forum for deeper discussion on priority matters, such as financial sector taxation, common consolidated corporate tax base and the new VAT Strategy. What are the prospects for tax harmonization? (in French) lire la suite

-

4 novembre 2010

The 2010 French pension reform

The 2010 French pension reform has now been passed by the French Parliament, after weeks of protests, strikes and even riots, all of which have aroused incomprehension in foreign media. The headline increase of the “legal retirement age” from 60 to 62 sounded to most pundits a very small step towards the sustainability of public finances when many European countries have already increased normal retirement age to age 67 or even 68. This short piece is not about the reasons behind the acute reaction of the French street – which would encompass much more than pensions. It aims simply at presenting the reform, its likely distributional impact and its effect in terms of financial sustainability. (in French; Italian version on LaVoce, English version to be published on VoxEU). lire la suite

-

23 juin 2010

Emergency vs. Emergency

In 1980, the French public debt amounted to 20% of GDP. In 2007, before the crisis, it had risen to 65%. By 2011, it could exceed 85%. The time has come to roll the debt back. It is an urgent task to design a process that reverses the political failures of the last thirty years. But it is equally important to ensure that the weak recovery under way does not stall or, worse, that we end up with a new recession. Thus we face two seemingly incompatible emergencies. Governments seem owed by the financial markets’ “request” for stern deficit-cutting measures, but the markets seem to understand that a new recession will deepen the deficit. This article argues that there is no such incompatibility. (in French) lire la suite

-

20 juin 2010

Senior Workers: Less Charges, More Jobs?

In order to increase the proportion of employed senior workers, it has been suggested to cut their and their employers’ social security contributions. That proposal deserves attention, since it acknowledges the necessity of raising the senior workers’ employment rate, still very low in France. But such a policy may be flawed and in the context of the pension system reform one may think twice before implementing it. (in French) lire la suite

-

21 mai 2008

Is Sarkozy’s Fiscal Policy Supporting reforms?

The ‘fiscal package’ passed on 21 August 2007 (known in France under its acronym ‘TEPA’) was sold by the new government as an important tool to bolster confidence and thus make reforms easier. Since then, it has become the main target of the government critics in the French political debate. When the project was made public, we had concluded that, from a strict economic angle, the fiscal side of the first reforms announced by PM Francois Fillon was ‘an unnecessary fiscal stimulus without long-term merits’. Real life has confirmed this diagnosis: the ‘fiscal shock’ was based on flawed economics, namely that fiscal stimulus generate high growth returns, and proved counter-productive in the French political debate. Yet, the new government’s fiscal policy is not as negative as some critics are saying, and it is not too late to re-design it so that budget decisions would support structural reforms. lire la suite

-

14 juin 2007

Tax-free extra hours worked: not such a bad idea, after all

As a candidate, Sarkozy promised to reform labour markets. His first move concerns the infamous 35 hours workweek, not really a surprise. The shorter workweek had been introduced by the socialist government of Jospin with the explicit aim of sharing work to increase employment. It followed on earlier moves under President Mitterrand in the 1980s and under President Chirac in the 1990s. That the idea was mistaken may be obvious to (non-French) economists, but it remains controversial in France because substantial subsidies, introduced when the Jospin government realized that the measure could, well, actually reduce employment, make it difficult to identify its effects. lire la suite

-

6 octobre 2006

French Budget: Walking the Fine Line

The 2007 budget should be a decently good vintage for the French economy, given the extraordinary electoral circumstances that will prevail in 2007: Presidential election in May, followed by general elections in June. Against this backdrop, one would have expected the incumbent government to flatter the electorate by injecting some growth boosters by means of budgetary stimulus, leaving to its successor the task to clean up the fiscal mess. My reading of the draft budget as it is now in the hands of the National Assembly is that it is a fair compromise between electoral contingencies and the imperious necessity to rationalize public spending, streamline the tax system, and cut the ballooning public debt. Actually, the public debt should decline already this year, as a percentage of GDP, for the first time since 2001. lire la suite

-

21 juillet 2006

Taxing the added value is not a good idea

In his seasonal greetings to the press French president Jacques Chirac proposed to widen the tax base for employers' contributions to social security from wages to value added. The idea of cutting employers' payroll contributions to foster employment is not distinctively French. Instead the idea of financing it by widening the tax base from wages to value added certainly is: In general, governments tend to finance reductions in employers' social security contributions through the general tax system. This is the case of the German coalition government that plans to finance a reduction in employers' contributions to unemployment insurance from 6.5% to 4.5% through receipts from the general tax system. lire la suite

-

16 janvier 2006

Protectionists without borders

Representatives from 150 member countries of the World Trade Organization met in mid-December in Hong Kong, aiming to expand trade flows and improve trade rules. The city's enormous convention center welcomed thousands of delegates representing governments, the private sector, NGOs, journalists, and multilateral organizations. Outside the huge facility, tens of thousands of anti-globalization activists once again protested, against neo-liberalism and trade liberalization. An unnecessary protest, since the gathering proved there is no great conceptual difference between the views of those inside and outside the great WTO bi-annual media theater. lire la suite

-

12 janvier 2006

The Value-Added Contribution: A Flawed Strategy

During his seasonal greetings to the press, President Chirac revealed that he had asked the cabinet to review the tax base of employers' social contributions. The reform he proposes would penalize capital intensive industries relatively to labour intensive ones; in the long term, it would backfire. lire la suite