-

4 juillet 2023

Kazakhstan, the imperative to cooperate

Landlocked in the heart of Central Asia, Kazakhstan is involved in regional partnerships and, pragmatic, claims to be a facilitator with balanced relations, even if the pressure to take a stand between Russia, China and the European Union is strong. This cocktail is the challenge of so-called middle power (or bridge) countries, developing multi-factor diplomacy, here constrained by geography and made possible by the country’s resources. Moreover, the development and identity of the five Central Asian countries are built around the imperative of cooperation, given the geographical position and the small number of citizens (75 million for the five countries). lire la suite

-

24 février 2021

Africa’s food security requires accurate trade statistics

Africa’s trade flows, particularly in the agriculture and food products sector, are known to be very underestimated, suggesting there is a considerable margin of error. This greatly hampers the continent's governments in making policies for food security. Yet some improvements are in sight. A well-structured partnership between private operators, apex organizations, national statistical institutes, and international institutions can make an important contribution to improving Africa’s international trade statistics. lire la suite

-

24 juin 2020

COVID-19 in developing countries: whatever it takes?

Latin American and African countries, in particular those that are more connected to the world economy, are already experiencing the economic impact: collapse in commodity prices, falling tourists’ revenues, drop in remittances, massive capital outflows. There is need for a global and effective response to the virus. lire la suite

-

29 novembre 2011

Is Asia afraid of China?

At the 6th East Asian Summit in Bali on 19th November the Chinese Premier, Wen Jiabao, found himself the butt of almost universal criticism from the leaders of the ten-member Association of Southeast Asian Nations (ASEAN) both for Chinese territorial claims and recent provocative actions in the South China Sea. Supported by the United States as well as India, Australia and Japan, the ASEAN countries insisted on multilateral negotiations over these questions, while the Chinese remained firm on the principle of bilateral solutions in which they would have a distinct asymmetrical advantage. lire la suite

-

26 novembre 2011

Strategic Games around Free Trade Agreements in the Asia-Pacific

Barely a week after the G20 in Cannes, ten of the 20 leaders reconvened half way across the world in Honolulu as part of the annual summit of the Asia-Pacific Economic Cooperation forum (APEC), together with other Pacific Rim leaders. APEC summits are usually quiet and polite affair. This time, however, APEC became the scene of great diplomatic games and one more match in the growing strategic rivalry between China and US. Indeed, the US decided to use APEC as platform for strategic reengagement into Asia and balancing China’s growing dominance. This game may well be the one with the most significance for the future of the world economy. lire la suite

-

17 avril 2011

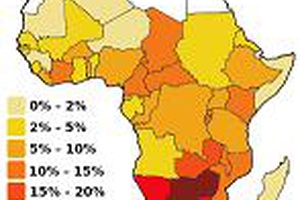

Africa, AIDS and governance

Sub-Saharan Africa is by far the world region most affected by AIDS. It is estimated, according to UNAIDS, 2.2 million people were newly infected with HIV / AIDS in 2008, bringing to 24.1 million people living with HIV / AIDS in the worst case. Because there seems to be a link between AIDS and poverty in Africa, and a link between poverty and bad institutions, the epidemic raises the question of the quality of institutions, and after all, it can appear as an incentive to improve institutions. lire la suite

-

18 février 2011

The fog of currency war

One way to expose the economic mumbo-jumbo that is applied to the Chinese exchange rate by otherwise respectable economists is to look at it from the perspective of Germany and international trade. China-bashers, who from stuttering economies lecture those who have presided over the biggest economic miracle that has occurred without thieving foreign lands or labour, like to focus on current account imbalances. A better measure of competitiveness would be the trade account. The current account includeshot money inflows that come under the exchange control restrictions and have ballooned since the China-bashers created the belief that the renimbi is a one-way appreciation bet. Chinas annual trade surplus with the world was $184.5bn at the end of 2010 or 3.6% of GDP. More than ten significant economies have a larger trade surplus as a percent of GDP than China. Natural-resource-poor Germany is the most interesting analogy and it has the largest 12-month trade surplus in dollar terms in the world: $205.4bn or 6.0% of GDP. (in French) lire la suite

-

4 février 2011

Energy: Nabucco’s comeback

Since its launching in 2002, the Nabucco pipeline project has had several lives. Many times it was given as death, but it finally managed to rise from its own ashes. Even though the Russian-Ukrainian gas crisis in 2006 transformed Nabucco into a top priority European project, in the last few years it advanced a little but backed up a lot, resulting in barely concealed mockery. This pattern is true and depicts Nabucco’s situation before the economic crisis. The latter, with its negative effects, brought a breath of fresh air for the European project and its proponents have used it rather wisely. The latest developments in Azerbaijan and Turkmenistan are encouraging with regard to the equation of supply sources. It seems that Nabucco is back. lire la suite

-

15 octobre 2010

The Two Rebalancing Acts

A “strong, balanced, and sustained world recovery” as demanded by the G20 is a daunting challenge for policymakers. This column argues that two rebalancing acts are required: internal rebalancing – replacing government spending with private-sector demand, and external rebalancing – addressing the global imbalances between exporting and importing countries. These two rebalancing acts, it adds, are taking too long. (French version on Telos, English version on VoxEU). lire la suite

-

16 septembre 2010

Is G20 economic coordination already passé?

Since the G20 leaders first met in Washington in November 2008, much hope has been placed in this new coordination group for the global economy. The G20 summit meeting in London in April 2009 will especially go down in history as the moment when leaders from the world successfully united forces to ward off depression. But times have changed and after a rather disappointing summit meeting in Toronto last June, there are grounds to ask whether international economic coordination among G20 countries is already passé. lire la suite

-

25 juin 2007

Thanks, Asia, for your prudent policies

Economists tend to say that markets have short memories, in an attempt to explain why, seemingly, markets do not apply large enough discounts to some asset prices even after episodes of turmoil. However, economists typically ignore the fact that they also seem to have short memories and that, often, simplification prevails over careful analysis. A clear example is the ongoing commentary bashing Asian countries for a variety of assorted reasons: adopting mercantilist policies, having learnt the wrong lessons from the 1997 crisis, risking heavy capital losses from their exchange rate reserves, managing their currencies, self-inflicting standard of living costs, etc. While this commentary is largely the result of the fashionable discussion on the global imbalance, and while this is a very convenient way of providing arguments for politicians so that they can tackle, in a partial, biased and inefficient way, the problem of rising income inequality in the Western world, the truth of the matter is that few people seems to remember the conclusions of the post-crisis analysis back in 1997-98 and the policy implications of such conclusions. Ten years later, the Asian crisis feels like a very old event and memories seem to be blurring. lire la suite

-

22 novembre 2006

Europe and Chindia

Overseas acquisitions by Indian companies have suddenly gone on top gear. In the first nine months of 2006, there were 112 foreign acquisitions by Indian companies with a combined deal value of $7.2 billion. Last year it was $4.5 billion, which was itself several times more than the figure for 2004. What is triggering this surge, why now, and why it should worry the Europeans? -->Let us examine the combination of the four factors which seems to interplay in this sharp turnaround: lire la suite

-

6 novembre 2006

Microcredit: Is it limited to village economies?

This year's Nobel Peace Prize was awarded to a former Professor of Economics, Muhammad Yunus, the inventor of group-lending microcredit in 1976. When the then Professor of Economics at Chittagong University, in Bangladesh, bet on the poor as being bankable individuals by creating the Grameen Bank, in the nearby village of Jobra, he extended tiny loans to poor individuals without collateral out of his own pocket. His motivation was to help such villagers to finance their investment projects, and, eventually, pull them out of poverty. His idea was a successful one, as Grameen replications mushroomed worldwide in the developing world and Eastern Europe, now reaching nearly seven million individuals living under the poverty line. What is exactly Yunus' innovative idea all about, and what made it replicable beyond Bangladeshi villages? lire la suite

-

6 juin 2006

ALCA versus ALBA

The decision by Bolivia to nationalize its natural gas and petroleum industries is going to result in heavy losses for Brazil, but it also shows that populism and contract breaches continue to be an "easy way out" for Latin America to justify its refusal to introduce much needed reforms. Nations in the region tend to periodically succumb to the temptation of using their vast natural resources to reach political objectives. lire la suite

-

15 mai 2006

Energy Supply and Energy Security: a Mexican Perspective

Oil prices have almost doubled in the past two years. After having breached the 75 dollar a barrel threshold for brief periods the market seems ready to test a price of 80 dollars for WTI, while global demand continues to grow. Future prices on the NYMEX are currently above 70 dollars until December of 2012. Yesterday the far dated quotes reached a new record. Refining margins have remained high and the average retail price of gasoline in the US should be higher this summer than last year. Prices are reflecting multiple constraints and imbalances along all of the supply chain. Capacity increases will be limited for at least the next three years, both in the upstream and in the downstream. More important, the oil service sector as well as construction and engineering companies are not able to meet their costumers' requirements. The resulting cost inflation is contributing to a shift of oil industry supply curves. lire la suite

-

25 janvier 2006

Davos, Globalization and the Poor

Are the poor made better off by globalization, as most orthodox economists and certainly the IMF and World Bank believe? Or are the poor hurt by global competition, as many anti-globalization activists would suggest? The orthodox view (the so-called «Washington Consensus») is frequently wrong: at best, openness to trade needs to be accompanied by many other policies that will allow the poor to take advantage of what globalization has to offer. New evidence suggests that there are four important lessons world leaders need to take into account. lire la suite

-

12 décembre 2005

Chile, Mexico & Brazil: the triumph of pragmatism

In December, the Chileans celebrated a new round of elections. However, beyond this event, there is yet another point worth celebrating: the profound and subtle transformation which is taking place in Chile and in Latin America stemming from the surge of economic pragmatism outside the predetermined paths of any rigid ideological model. -->The example of Chile The Chilean example is, from this point of view, exemplary (and perhaps unique), where the privatization of pension funds remained within the framework of a jewel of regulation of top quality institutional craftsmanship. Year after year, the system was modified and adjusted in order to improve. Today, the Chilean regulation body, the Superintendencia, is one of the most credible, technically prestigious and highly esteemed institutions in the country, making it a strong institutional mast. lire la suite